rsu tax rate india

When you sell the your RSUESOPESPP after vesting period is over and get back the money its your responsibility to pay the tax on the amount in India. Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide.

Rsu Of Mnc Perquisite Tax Capital Gains Itr

It will be taxed as short term capital gains.

. I have RSU as part of my compensation. Answer 1 of 2. Carol Nachbaur March 24 2022.

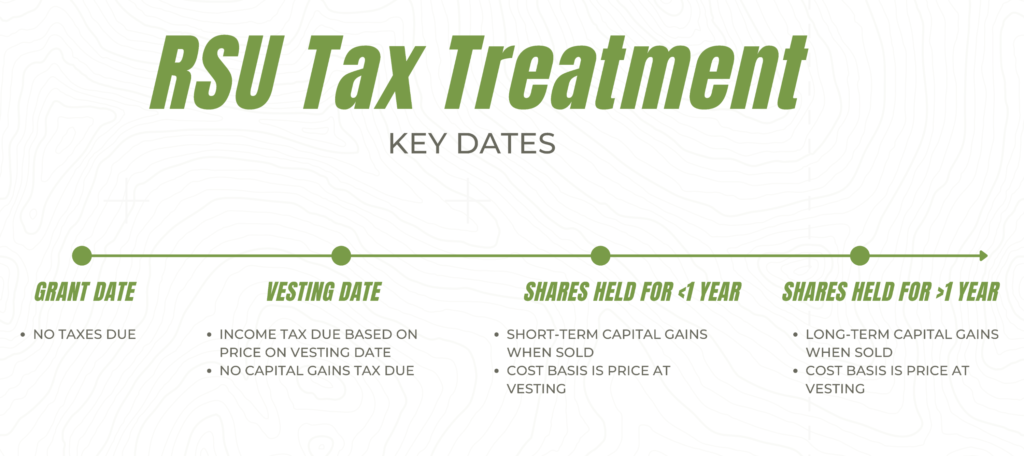

In fact there are only two rules viz. At the time of vesting. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers.

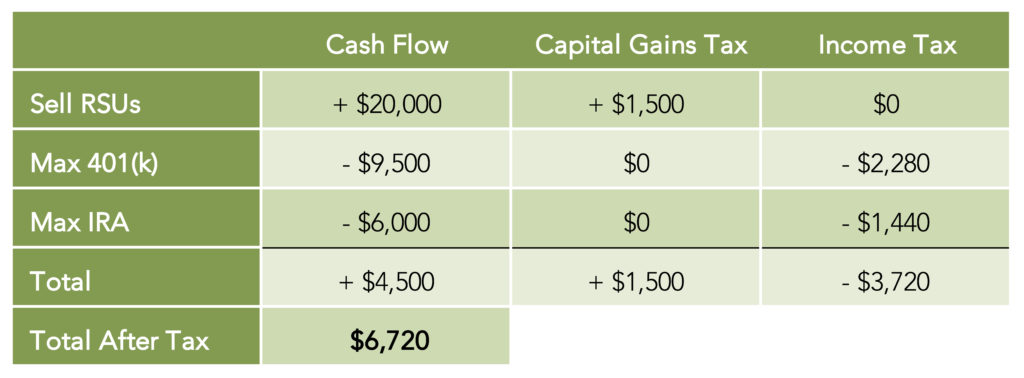

The capital gains tax rate when you sell the shares you own. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained. This year when my RSU stocks vested stocks were sold to cover taxes.

When the RSU vest with the employee he need to include it in his salary income as perquisite and pay tax on same. What about tax withholding on my RSU income. RSU Taxes - A tech employees guide to tax on restricted stock units.

Unlike the much more complicated ESPP they get taxed the same way as your income. Its important to remember that the RSU tax rate will be the same as your income tax rates. Is the top marginal tax rate in India 43 including surcharge etc If not I cant see any case where it would be required.

Taxes to be paid in India and stocks listed on foreign exchanges. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. I have signed w8ben treaty through by trading partner account to avoid double taxation.

Also Uber should move to a better brokerage. For Taxes to be paid in India. The loss from the sale of shares can be carried forward up to 5 years.

The beauty of rsus is in the simplicity of the way they get taxed. 1 At the time of vesting and 2 At the time of sale. Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck.

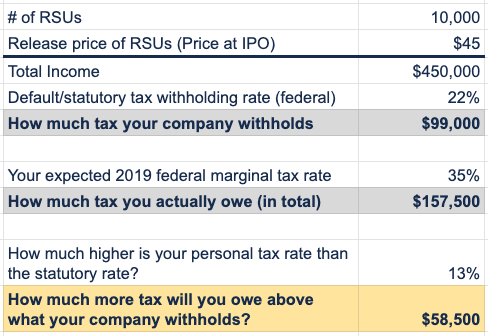

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock. Most companies will withhold federal income taxes at a flat rate of 22. Let us say you are a Resident of India and hence your global income gets taxed in.

RSU Tax Rate vs. Please note that if your RSU income is taxed above 22 when your taxes. Depending on the holding period of the stock either long term capital gains tax or short-term capital gains tax is applicable.

For tax planning purposes some restricted stock unit plans allow you to choose your grant date. This is true whether were talking about. I understand the 309 is the india tax.

The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part. Thus the RSU above attracts tax two times. For 2021 that rate is 22 on supplemental wages up to 1 million and 37 for wages in excess of 1 million.

10000 20 on income between rs. Wow that is quite bad. In order to make employee compensation more manageable for tech companies at least a portion of it can.

How much tax is to be paid by you depends on the nature of the gains. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. The beauty of RSUs is in the simplicity of the way they get taxed.

Tax treatment of RSUs in India. Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. This is the date you actually receive your stocks and it may be different from your vesting date.

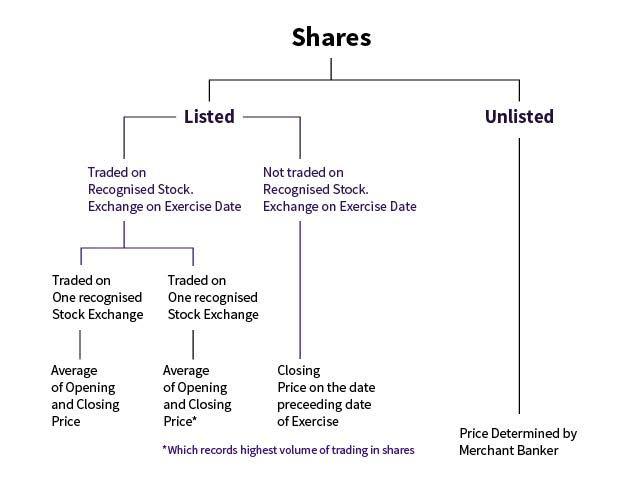

The value of over 1 million will be taxed at 37. Rsu Tax Rate India. Tax treatment of RSUs in India The RSU perquisite is taxable based on the period of stay during the vesting period.

Tax to be paid in India. Hi The Income tax implication here in India entirely depends on whether you are a resident of India or a non resident of India from Income Tax perspective. On this page is a Restricted Stock Unit Projection calculator or RSU calculator.

RSU Tax Rate vs. For RSUs the profitgain is the difference between the sale price and the vesting price. RSU Withholding Rate A Common Confusion.

When an employee sells their ESPP ESOP or RSU once the vesting period is complete and receive their money. RSU are offered to many employees these are common and in most of the cases the amount is transferred to indian Bank Account. At any rate RSUs are seen as supplemental income.

The RSU perquisite is taxable based on the period of stay during the vesting period and resident status at the time of the grant of option. Hi Im a Resident of India working for MNC. Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns.

The Company I work for has its stock listed in US markets. On the sale of RSUs ESOPs and ESPPs the gainsprofit made are subject to capital gains tax. RSUs can also be subject to capital.

How Are Restricted Stock Units RSUs Taxed. Most companies dont withhold taxes according to your W-4 rate but will instead use the flat IRS rate for supplemental wage income. When preparing taxes in 2021 her actual tax due from RSUs is 37000 37 ordinary income tax rate 100000 Tax surprise - Since funds from her RSUs redemptions were withheld at the 22 supplemental rate she has to come up with an additional 15000 out-of-pocket to pay her taxes due on April 15th.

The companies many a times sell certain portion of such shares after vesting to pay the tax on such vesting. For STCG where the securities transaction tax is applicable the applicable tax rate is 15 surcharge and health and education cess. RSU Tax Rate.

Even Google has support for fractional shares now like in your example they sell exactly 215 shares and not 3. Choosing the date you take possession of your stock can help you know when youll have to pay tax on the stock issuance but few plans offer this perk. The ordinary earned income tax rate when the RSUs vest or.

From there the RSU projection tool will model the total economic value of your grant over the years. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. You need to pay the difference of tax rate in India and US.

Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. RSU taxation in India.

Here is an article on employee stock options. On the sale of rsus esops and espps the gainsprofit made are subject to capital gains tax.

How Are Esops Rsus Taxed In India Aditi Bhardwaj Co

Restricted Stock Units Rsu Meaning Taxation How It Works Blog By Tickertape

Understanding Rsu Esops Espp Tax Implications Mymoneysage Blog

Getting Esop As Salary Package Know About Esop Taxation

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Espp And Esop Understanding Meaning And Taxation

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Relooking Esop Taxation The Hindu Businessline

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Tax In India On Income Earned From Rsu Vested In Foreign Countries And Exemption From Such Income Taxontips

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Income Tax Implications On Rsus Or Espps